PDF) Central Clearing of OTC Derivatives: Bilateral vs Multilateral Netting

PDF | On Jan 1, 2012, Rama Cont and others published Central Clearing of OTC Derivatives: Bilateral vs Multilateral Netting | Find, read and cite all the research you need on ResearchGate

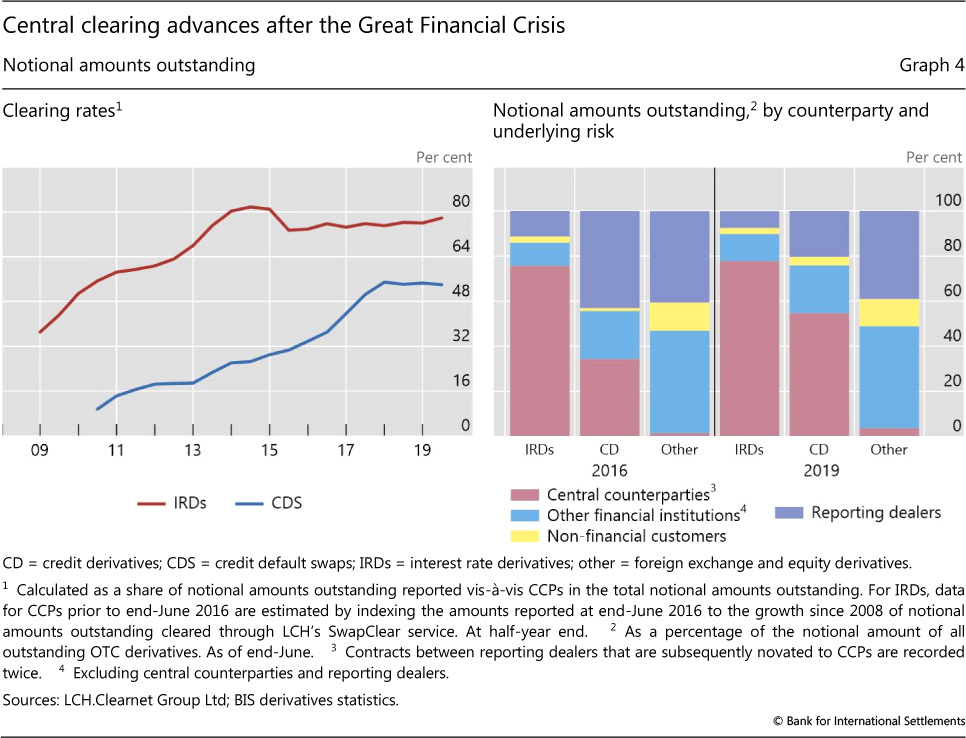

OTC derivatives: euro exposures rise and central clearing advances

Applying the Central Clearing Mandate: Different Options for Different Markets in: IMF Working Papers Volume 2022 Issue 014 (2022)

OTC Derivatives Reform: Netting and Networks, Conference – 2013

PDF) Central Clearing of OTC Derivatives: bilateral vs multilateral netting

Applying the Central Clearing Mandate: Different Options for Different Markets in: IMF Working Papers Volume 2022 Issue 014 (2022)

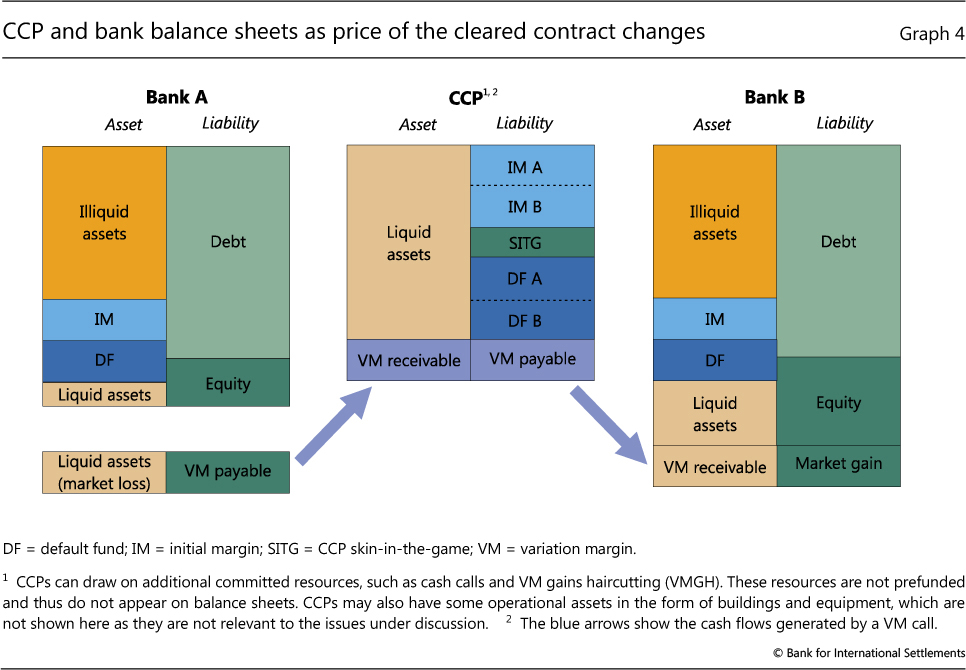

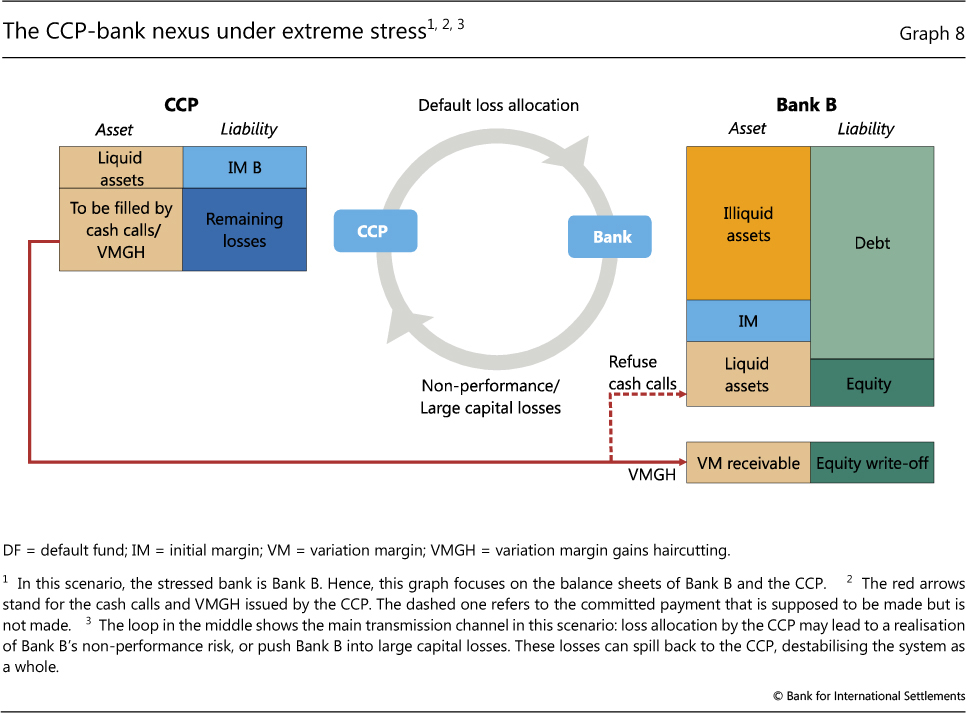

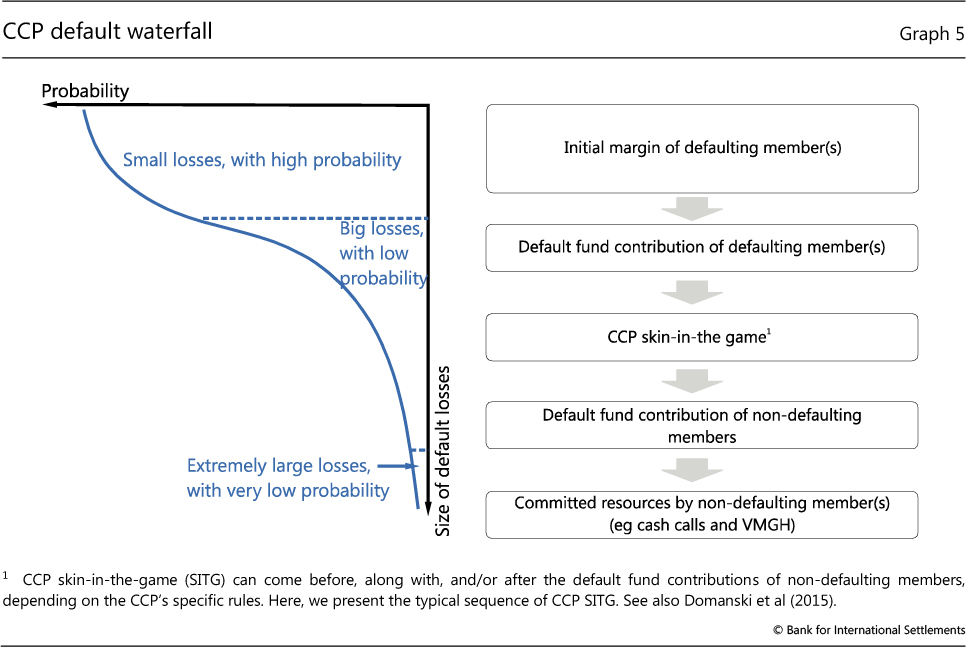

Clearing risks in OTC derivatives markets: the CCP-bank nexus

Clearing risks in OTC derivatives markets: the CCP-bank nexus

Clearing risks in OTC derivatives markets: the CCP-bank nexus

House of Lords - The future regulation of derivatives markets: is the EU on the right track? - European Union Committee

Applying the Central Clearing Mandate: Different Options for Different Markets in: IMF Working Papers Volume 2022 Issue 014 (2022)

PDF] 1 “ Predatory ” Margins and the Regulation and Supervision of Central Counterparty Clearing Houses ( CCPs ) 1 by

Central clearing: trends and current issues