Key Concepts and Skills - ppt download

Chapter Outline Float and Cash Management Cash Management: Collection, Disbursement, and Investment Credit and Receivables Inventory Management Inventory Management Techniques

Chapter 17 Working Capital Management

Understand how firms manage cash and various collection, concentration and disbursement techniques. Understand how to manage receivables and the basic components of credit policy. Understand various inventory types, different inventory management systems and what determines the optimal inventory level.

Cash Management: Collection, Disbursement, and Investment. Credit and Receivables. Inventory Management. Inventory Management Techniques.

Speculative motive – hold cash to take advantage of unexpected opportunities. Precautionary motive – hold cash in case of emergencies. Transaction motive – hold cash to pay the day-to-day bills. Trade-off between opportunity cost of holding cash relative to the transaction cost of converting marketable securities to cash for transactions.

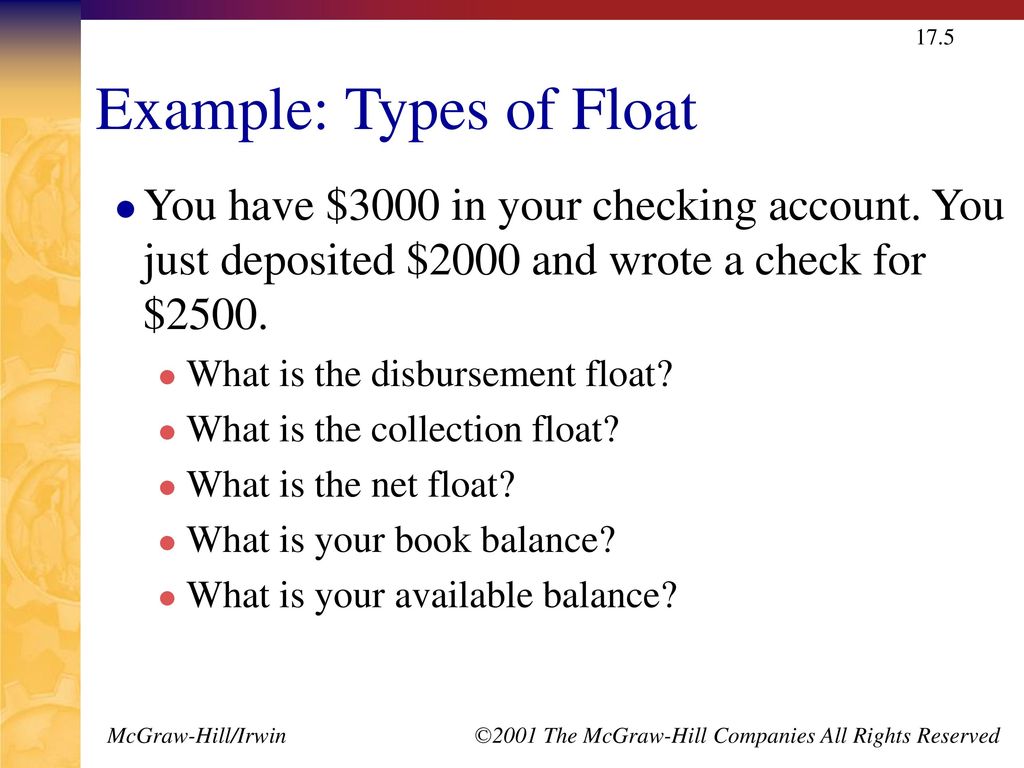

Disbursement float. Generated when a firm writes checks. Available balance at bank – book balance > 0. Collection float. Checks received increase book balance before the bank credits the account. Available balance at bank – book balance < 0. Net float = disbursement float + collection float. The available balance is more important than the book balance. The firm doesn’t want to bounce checks, but they also don’t want to carry excess cash.

You have $3000 in your checking account. You just deposited $2000 and wrote a check for $2500. What is the disbursement float What is the collection float What is the net float What is your book balance What is your available balance Disbursement float = $2500. Collection float = -$2000. Net float = 2500 – 2000 = $500. Book balance = $ – 2500 = $2500. Available balance = $3000.

Mailed Received Deposited Available. Mailing Time. Processing Delay. Availability Delay. Collection Delay. Reducing mailing time – lockboxes, Figure 17.1 illustrates how lockboxes can reduce mail delay by having customers mail their payments to PO boxes that are closer to where they live. The processing delay is also reduced because bank employees process the checks instead of the company doing it and then taking the checks to the bank. Cash concentration – reduce management time by having a systematic process for moving cash received in the lock-boxes to a central account. Allows the company to maintain smaller cash balances overall. One of the goals of float management is to try and reduce the collection delay. There are several techniques that can reduce various parts of the delay.

Controlling disbursements. Zero-balance account. Controlled disbursement account. Slowing payments – not ethical to systematically pay bills late; may lose cash discounts by paying late and this can be very expensive. Zero-balance account: maintain a master account, when checks are written on sub-accounts, cash is transferred from the master account to the sub-account to cover the checks; can maintain a smaller overall cash balance by utilizing this technique. Controlled disbursement account – cash is transferred to bank account to cover the day’s anticipated payments.

Seasonal or cyclical activities – buy marketable securities with seasonal surpluses, convert securities back to cash when deficits occur. Planned or possible expenditures – accumulate marketable securities in anticipation of upcoming expenses.

Short-term financing. Total financing needs. Bank loans. Marketable securities Time 1: A surplus cash position exists. Seasonal demand for current assets is low. The surplus is invested in short-term marketable securities. Time 2: A deficit cash position exists. Seasonal demand for current assets is high. The financial deficit is financed by selling marketable securities and by bank borrowing.

Maturity – firms often limit the maturity of short-term investments to 90 days to avoid loss of principal due to changing interest rates. Default risk – avoid investing in marketable securities with significant default risk. Marketability – ease of converting to cash. Taxability – consider different tax characteristics when making a decision.

Granting credit increases sales. Costs of granting credit. Chance that customers won’t pay. Financing receivables. Credit management examines the trade-off between increased sales and the costs of granting credit.

Credit Sale Check Mailed Check Deposited Cash Available. Cash Collection. Accounts Receivable.

Terms of sale. Credit period. Cash discount and discount period. Type of credit instrument. Credit analysis – distinguishing between good customers that will pay and bad customers that will default. Collection policy – effort expended on collecting on receivables.

2% discount if paid in 10 days. Total amount due in 45 days if discount not taken. Buy $500 worth of merchandise with the credit terms given above. Pay $500( ) = $490 if you pay in 10 days. Pay $500 if you pay in 45 days.

Finding the implied interest rate when customers do not take the discount. Credit terms of 2/10 net 45 and $500 loan. $10 interest (.02*500) Period rate = 10 / 490 = % Period = (45 – 10) = 35 days. 365 / 35 = periods per year. EAR = ( ) – 1 = 23.45% The company benefits when customers choose to forego discounts. Cash discounts are designed to shorten the receivables period, however, you reduce your sales level when discounts are taken.

Figure 17.5: The Cost of Granting Credit

Gathering information. Financial statements. Credit reports. Banks. Payment history with the firm. Determining Creditworthiness. 5 Cs of Credit. Credit Scoring. Credit scoring is less subjective than the five Cs, but firms have to be careful with the information they choose to include in the score, e.g. race, gender and geographic location cannot be included in the score.

Capacity – ability to meet financial obligations out of operating cash flows. Capital – financial reserves. Collateral – assets pledged as security. Conditions – general economic conditions related to customer’s business.

Keep an eye on average collection period relative to your credit terms. Use an aging schedule to determine percentage of payments that are being made late. Collection policy. Delinquency letter. Telephone call. Collection agency. Legal action. If the average collection period is well outside your credit terms, then there is definitely a problem. If you offer a discount and the ACP is not less than your net terms, then there is probably a problem. An aging schedule can help you pinpoint if you have customers paying late more or less across the board or if there are a few customers that are paying really late.

Costs associated with not carrying enough inventory. Inventory management tries to find the optimal trade-off between carrying too much inventory versus not enough.

Raw material – starting point in production process. Work-in-progress. Finished goods – products ready to ship or sell. Remember that one firm’s raw material may be another company’s finished good Different types of inventory can vary dramatically in terms of liquidity.

Insurance and taxes. Losses due to obsolescence, deterioration or theft. Opportunity cost of capital. Shortage costs. Restocking costs. Lost sales or lost customers. Consider both types of costs and minimize the total cost.

Classify inventory by cost, demand and need. Those items that have substantial shortage costs should be maintained in larger quantities than those with lower shortage costs. Generally maintain smaller quantities of expensive items. Maintain a substantial supply of less expensive basic materials.

Total carrying cost = (average inventory) x (carrying cost per unit) = (Q/2)(CC) Total restocking cost = (fixed cost per order) x (number of orders) = F(T/Q) Total Cost = Total carrying cost + total restocking cost = (Q/2)(CC) + F(T/Q) The optimal order quantity is where the cost function is minimized. This will occur where total carrying cost = total restocking cost. If your students have had calculus, you can have them verify that taking the derivative, setting it equal to zero and solving for Q provides the same result.

Consider an inventory item that has carrying cost = $1.50 per unit. The fixed order cost is $50 per order and the firm sells 100,000 units per year. What is the economic order quantity Total carrying costs = (2582/2)(1.50) = Total restocking costs = 50(100,000)/2582 =

Minimum level of inventory kept on hand. Increases carrying costs. Reorder points. At what inventory level should you place an order Need to account for delivery time. Derived-Demand Inventories. Materials Requirements Planning (MRP) Just-in-Time Inventory.

What is the implied rate of interest if credit terms are 1/5 net 30 What are the two main categories of inventory costs What components are required to determine the economic order quantity Implied rate of interest = (1 + 1/99)(365/25) – 1 = 15.80%

Key Concepts and Skills - ppt download

Key Skills PowerPoint Presentation and Slides

18 Printable Presentation Skills Ppt Forms and Templates - Fillable Samples in PDF, Word to Download

Key Concepts and Skills - ppt download

Key Concepts and Skills - ppt download

Key Concepts and Skills - ppt download

Concepts, skill and values

PPT] Presentation Skills for Managers PPT Download - PPT CLUB

Presentation Skills Ppt PowerPoint PPTX Template Free Download - Pikbest

Key Concepts PowerPoint Templates

Key Concepts and Skills - ppt download

:max_bytes(150000):strip_icc()/noncash-item_final-a755ac862fea40629e736a5cedcf5ebe.png)